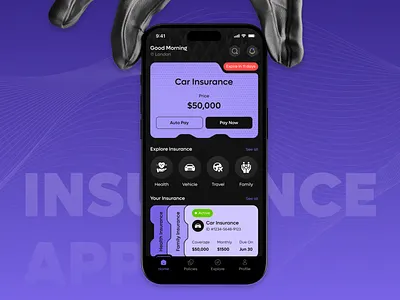

In today’s fast-moving digital world, managing insurance has become easier than ever. Gone are the days when people had to visit offices, wait in long queues, or deal with piles of paperwork to buy or renew insurance. Thanks to technology, you can now manage everything from your smartphone using insurance apps. These apps help you compare policies, buy plans online and file claims within minutes. Let us explore the best insurance apps that make life easier, safer and more secure.

Why Use Insurance Apps

Insurance apps bring convenience to your fingertips. They allow you to access policy details instantly and remove the hassle of visiting branches. Whether you want to buy health insurance, car insurance, bike protection, travel insurance or life plans, these apps offer everything in one place. The biggest advantage is transparency because you can compare premium prices and benefits before making a decision. Insurance apps are not just tools but also financial companions that help protect your future.

How Insurance Apps Help in Financial Planning

Insurance is not just about protection but also about planning for the future. Through insurance apps, users can calculate premiums, check coverage options and choose what suits their budget. For example, a family can secure medical coverage through a health insurance plan without financial burden during emergencies. Similarly, car owners can renew vehicle policies before expiry and avoid penalties. These apps play a key role in preventing unexpected financial losses.

Top Features to Look for in an Insurance App

When choosing an insurance app, it is important to see if it offers easy navigation, fast claim settlement and secure payments. Good apps also provide digital policy storage so users do not lose documents. Customer support is another essential feature because insurance queries must be resolved quickly. Some apps also include AI assistance that recommends the best policies based on user needs. The best apps are simple to use even for beginners.

Popular Insurance Apps Used Today

Several trusted insurance companies offer apps that millions of users rely on. These apps cover different categories such as health, vehicle, life and travel insurance. Users can purchase term plans for life protection, get medical coverage with cashless treatment in hospitals or insure their vehicles for accidental damage. These apps also allow tracking policy status and downloading receipts, making everything transparent and accessible.

Ease of Claim Settlement Process

One major concern people have about insurance is claim settlement. Many users fear delays or rejections. However, modern insurance apps simplify claims. Users can upload documents online, track claim status and communicate with executives within the app. Some apps provide quick claim approval for simple cases, making the experience smooth. With digital verification, the entire process becomes faster and more reliable.

Benefits of Cashless Hospitalization

Health insurance apps often include details of network hospitals where cashless treatment is available. Instead of paying hospital bills from your pocket, the insurance provider directly settles the amount. This helps families during medical emergencies. Through apps, users can locate the nearest network hospitals in seconds, saving time and reducing stress. It adds a strong layer of security to healthcare planning.

Importance of Policy Renewal Reminders

Most people forget to renew their insurance before the due date. Insurance apps solve this issue by sending reminders. Whether it is a vehicle insurance renewal or health plan update, apps ensure users stay protected without policy lapses. Renewing on time also keeps users eligible for benefits like no-claim bonus or loyalty offers. Reminders are a small feature but play a big role.

Secure and Safe Transactions

Insurance apps use encrypted payment systems to ensure user safety. Users can choose from multiple payment methods such as UPI, debit cards, credit cards or net banking. These apps also maintain strong data privacy to protect personal information. Buying insurance online is not just easy but also safe when done through trusted apps. This builds trust and encourages more people to use digital insurance services.

Future of Insurance with Mobile Apps

The future of insurance is digital. With AI, blockchain and automation, these apps are becoming smarter. Soon, people will be able to purchase personalized insurance plans based on daily lifestyle. For example, fitness-based health plans or pay-as-you-drive motor plans are already being introduced. The insurance industry is evolving and mobile apps will continue to lead this progress.

Conclusion

Insurance apps have become an essential part of modern life. They make financial protection simple, fast and accessible. Whether it is health, life, travel or vehicle insurance, everything can be managed from a mobile phone without any paperwork. These apps encourage smart financial planning and create a stress-free experience for users. If you have not explored insurance apps yet, now is the right time to secure your future with technology.